food tax in massachusetts

A local option for cities or towns. Massachusetts has a separate meals tax for prepared food.

Massachusetts Stmab 4 Fill Out And Sign Printable Pdf Template Signnow

Local Option Meals Excise.

. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Specifically voters in Massachusetts voted to impose a 4 percent personal income surtax on income above 1 million. The Baker administration also set up a website wwwmassgov62frefunds where you can get a preliminary estimate of your refund.

The base state sales tax rate in Massachusetts is 625. The tax is levied on the sales price of the meal. Harvard researchers estimate adding pennies to sugary drinks alone would raise 368 million annually in Massachusetts.

2022 Massachusetts state sales tax. Effective in 2023 the new levy aims to. Massachusetts officials announced last week that 3 billion in surplus tax revenue will be returned to taxpayers.

The Boston Sales Tax is collected by the merchant on all qualifying sales made within Boston. Voters in Colorado voted to further limit federal itemized. In the closest-fought major race in Massachusetts voters Tuesday ended nearly eight years of debate about taxes on high earners narrowly approving.

Massachusetts tax refund calculator. The Massachusetts state sales tax rate. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

Exact tax amount may vary for different items. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes. That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate.

The Massachusetts sales tax is imposed on sales of meals by a restaurant. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019.

The sales tax is imposed upon admission charges collected by a place of entertainment where food alcoholic beverages or both are sold unless all the following. How is meal tax. This page describes the taxability of food and meals in Massachusetts including catering and grocery food.

The meals tax rate is 625. The sale of food products for human consumption is. Barry ChinGlobe Staff.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Massachusetts Department of Revenue DAIGO FUJIWARA TOM. How is meal tax.

The tax is 625 of the sales price of the meal. Anyone who sells meals. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close.

The meals tax rate is 625. The tax is 625 of the sales price of the meal. State Auditor Suzanne Bump announced Thursday that she had.

Groceries are exempt from the Boston and Massachusetts state sales taxes. In the state of Massachusetts any service charge by a caterer is not considered to be taxable so long as the caterer prepares food which was owned by the client at a fixed location. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on. Massachusetts voters approved a 4 tax on annual income above 1 million on top of the states current 5 flat income tax. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

And junk food taxes have shown no negative impact. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1.

Sales Tax Laws By State Ultimate Guide For Business Owners

Everything You Need To Know About Restaurant Taxes

Sports Betting Tax Relief Bills Expected To Emerge Sunday Top Massachusetts State Senator Says With Just Hours Of Formal Lawmaking Remaining Masslive Com

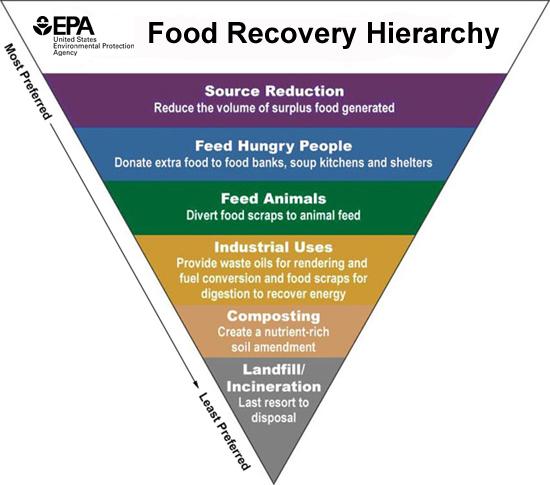

Food Donation Guidance Recyclingworks Massachusetts

Mass House Advances Bill To Create 2 Transfer Tax On Big Boston Real Estate Deals

In Massachusetts Retailers Cookies Will Soon Lead To Sales Tax

Massachusetts Tries New Bite At Sales Tax Revenue By Focusing On Internet Cookies

Massachusetts Sales Tax Small Business Guide Truic

Lee S Seafood At Joe S Playland Welcome

Massachusetts Tax Refund 2022 How To Calculate Your Rebate Nbc Boston

Junk Food Tax Boston Mayoral Candidate John Barros Says Yes Newbostonpost Newbostonpost

Sales Tax By State To Go Restaurant Orders Taxjar

Setting Up Tax Rates And Adjusting Tax Options

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

When Is Tax Free Weekend In Massachusetts Nbc Boston

Sales Taxes In The United States Wikipedia

Ripping Food Tax Animal Protection Question Opponents Form Committee Wbur News