monterey county property tax rate 2021

A county-wide sales tax rate of 025 is applicable to localities in Monterey County in addition to the 6 California sales tax. Download all California sales tax rates by zip code.

A county-wide sales tax rate of 025 is applicable to localities in Monterey County in addition to the 6 California sales tax.

. At any time prior to submitting the Statement for E-Filing you may printsave a draft copy for your review. You can print a 925 sales tax table here. The median property value of homes in monterey county is 393300.

See detailed property tax information from the sample report for 3452 Lazarro Dr Monterey County CA. Monterey County California sales tax rate details The minimum combined 2021 sales tax rate for Monterey County California is 775. The California state sales tax rate is currently 6.

Therefore no payments that are made during this period will be shown until at least july 2 2021. This is the total of state and county sales tax rates. The 2018 United States Supreme Court decision in South Dakota v.

The California state sales tax rate is currently 6. When contacting monterey county about your property taxes make sure that you are contacting the correct office. MONTEREY COUNTY TAX RATES FOR FISCAL YEAR 2020-2021 Rupa Shah CPA Auditor-Controller.

2021 Property Tax Calendar. 831 755-8439 Fax. The Median Maryland property tax is 277400 with exact property tax rates varying by location and county.

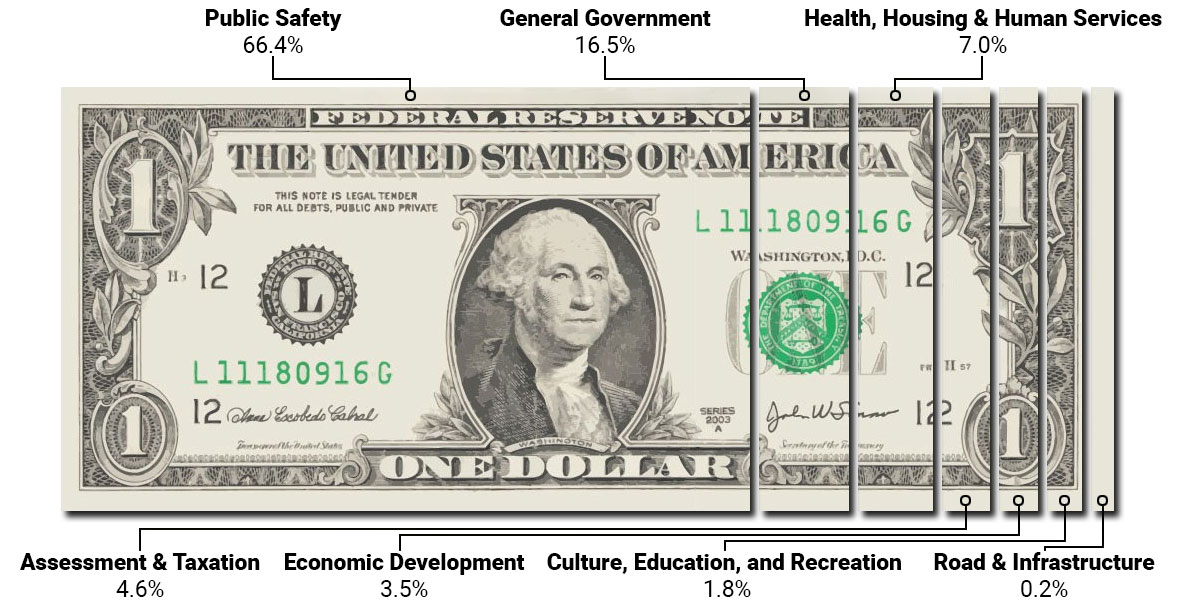

The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. New monthly reporting forms for the reporting period beginning in January 2021 are available below. Property taxes are due on the third Monday in August.

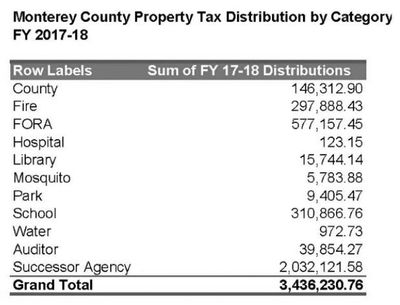

When you have completed the E-Filing process you should printsave a final copy of your Property Statement for your own records. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts. A county-wide sales tax rate of 025 is applicable to localities in Monterey County in addition to the 6 California sales tax.

You will need your 12-digit ASMT number found on your tax bill to make payments by phone. Monterey County Assessors Office Services. This is the total of state and county sales tax rates.

The minimum combined 2022 sales tax rate for Monterey County California is 775. Welcome to the E-Filing process for Property Statements. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value.

Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Heres how Monterey Countys maximum sales tax rate of 95 compares to other.

The median property value of homes in monterey county is 393300. The 925 sales tax rate in Monterey consists of 6 California state sales tax 025 Monterey County sales tax 15 Monterey tax and 15 Special tax. Find Information On Any Monterey County Property.

1055 Monterey Street Room D-120. 2022 Property Statement E-Filing E-Filing Process. The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

The sales tax jurisdiction name is Monterey Conference Center Facilities District which may refer to a local government division. The Median Tennessee property tax is 93300 with exact property tax rates varying by location and county. In 2021 the residential tax rate is 1093399 percent.

The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. Some cities and local governments in Monterey County collect additional local sales taxes which can be as high as 325. The Monterey County sales tax rate is.

The Consolidated Oversight Board for the County of Monterey was established in accordance with the California Health and Safety Code 34179j to oversee the activities of the ten redevelopment successor agencies in Monterey County thereby replacing all. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. Tax Rate Book for Fiscal Year 2020-2021.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. 1-831-755-5057 - Monterey County Tax Collectors main telephone number. Ad Find Monterey County Online Property Taxes Info From 2021.

1-831-755-5057 - Monterey County Tax Collectors main telephone number. Proposition 13 enacted in 1978 forms the basis for the current property tax laws. How much is Monterey County tax.

Yearly median tax in Monterey County. This is the total of state and county sales tax rates. Monterey County has one of the highest median property taxes in the United.

PRESS MEDIA RELATIONS Ph. South Monterey County Joint Union High School District 2012 Refunding 2018 Ser A A-1 0031408. The Monterey County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Monterey County and may establish the amount of tax due on that property based on.

Monterey County collects on average 051 of a propertys assessed fair market value as property tax. Hamilton County Property Tax Rate. The Monterey County Sales Tax is 025.

CITIES TAX RATE Marina 2015 GO Refunding Bonds 0022180. For assistance in locating your ASMT number contact our office at 831 755-5057. Only current year taxes may be paid by phone.

Tax Rate Book for Fiscal Year 2021-2022. The Monterey County sales tax rate is 025. Choose Option 3 to pay taxes.

The Monterey County sales tax rate is 025. Use a borough prefix for a quick parcel id search. 051 of home value.

Property Tax By County Property Tax Calculator Rethority

At A Glance Monterey County Monterey County Ca

Riverside County Ca Property Tax Search And Records Propertyshark

Assessment And Taxation Clackamas County

Additional Property Tax Info Monterey County Ca

Monterey Peninsula Chamber Of Commerce Montereychamber Twitter

Property Tax By County Property Tax Calculator Rethority

Governor Newsom Releases Proposed 2021 2022 Budget Would Consolidate Existing Licensing Agencies Create New Department Of Cannabis Control Law Offices Of Omar Figueroa

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

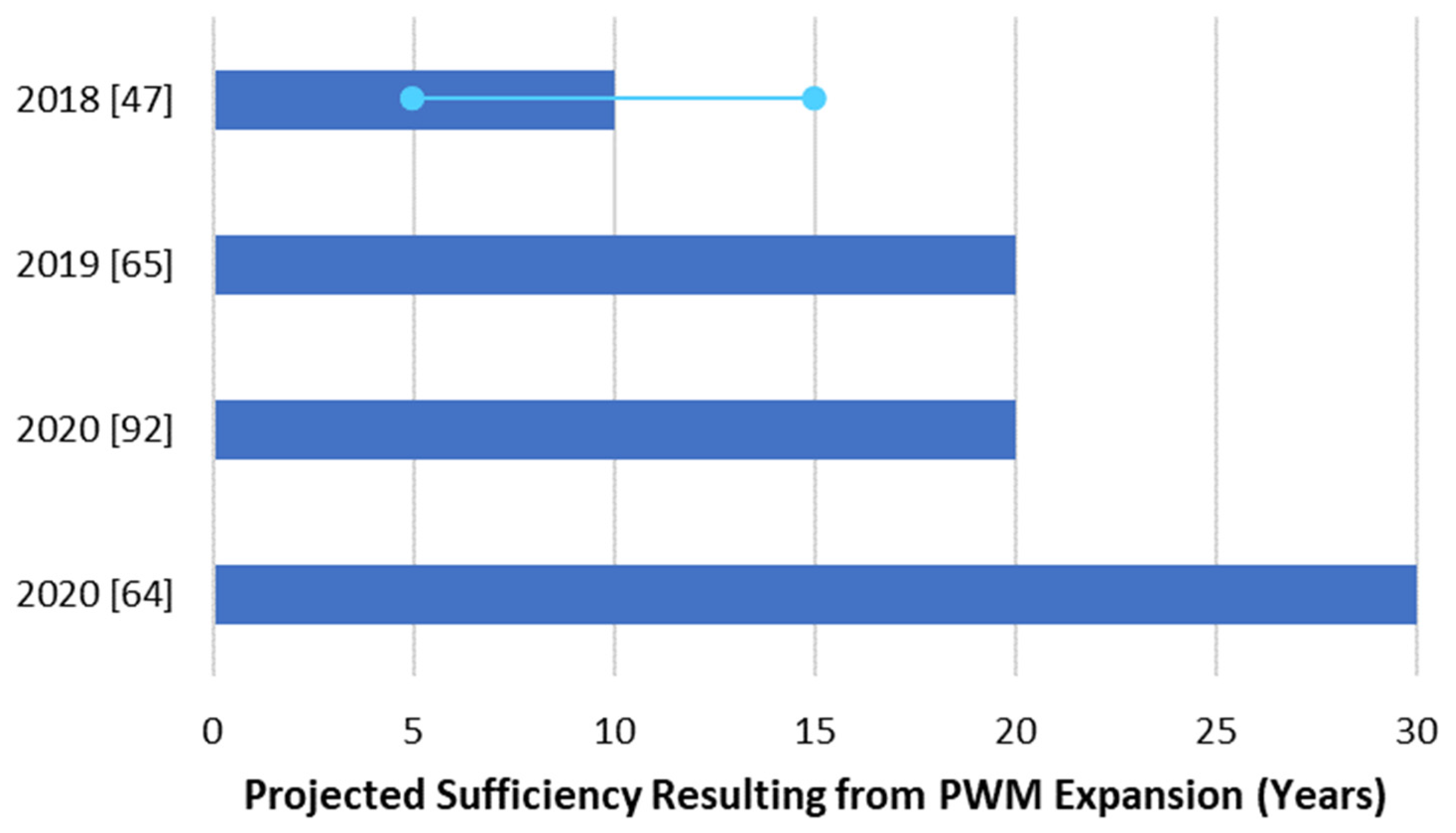

Water Free Full Text Integrated Water Management At The Peri Urban Interface A Case Study Of Monterey California Html

Transfer Tax Calculator 2022 For All 50 States

The California Transfer Tax Who Pays What In Monterey County

The California Transfer Tax Who Pays What In Monterey County